10 Reasons to Switch to Southland Credit Union

Because there are no shareholders to keep happy, credit unions are typically able to offer better rates and lower fees.

In fact, credit unions are known to offer higher rates on savings and certificates—and much lower rates on loans. That's because all profits come back to the members—not to a board of directors.

If you still do your banking with a traditional big bank, here are 10 reasons to consider switching to Southland Credit Union.

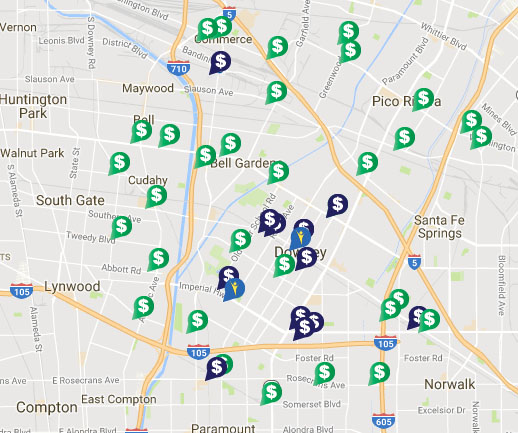

1.) More than 30,000 surcharge-free ATMs

Southland Credit Union members have access to literally tens of thousands of ATMs where you can withdraw money with zero surcharges.

2.) Mobile banking

With Southland Credit Union mobile banking, you can manage your money no matter where you are.

Easily access your balance information, transfer funds, pay bills or even find a branch or ATM. And it's all free.

3.) Free financial advice

How much can you afford? How much will this new car really cost?

Southland Credit Union has several financial tools available for its members, including auto loan calculators, savings calculators, mortgage calculators and credit card calculators.

4.) So You Want to be a Millionaire

Becoming a millionaire doesn't have to be a pipe dream.

Southland Credit Union has a customizable online calculator where you simply punch in your income details to find out what it would take to save $1 million.

5.) Identity theft protection

As a Southland Credit Union Member, you receive complete identity theft restoration if identity theft strikes. To obtain these services after you discover you are a victim could cost hundreds, possibly thousands of dollars.

Southland Credit Union provides this service to you for free.

6.) Loans, loans, loans.

If you need a loan, chances are Southland Credit Union can help.

They offer motorcycle loans, car loans, boat and RV loans, home loans, home equity lines of credit, investment property loans, and personal loans.

7.) Relationship Rewards

Great relationships deserve great rewards. The stronger your relationship with Southland Credit Union, the greater your rewards.

Relationship Rewards is designed to reward you increased savings and benefits for making Southland your primary financial partner. Earning Rewards is easy. If you qualify, you are automatically enrolled.

8.) Pop Money

Sending and receiving money with Popmoney personal payment service is as easy as sending an e-mail or text message.

Use your Southland account to pay or receive money from just about anyone, with no need to write a check, exchange account numbers or carry cash.

9.) Free, no-pressure financial seminars

Learn about homebuying, managing credit, investing, and more. Bring a friend, and rest assured there are no high-pressure sales tactics.